Crude oil at lowest since April; Brent at USD 103 and WTI dips below USD 100

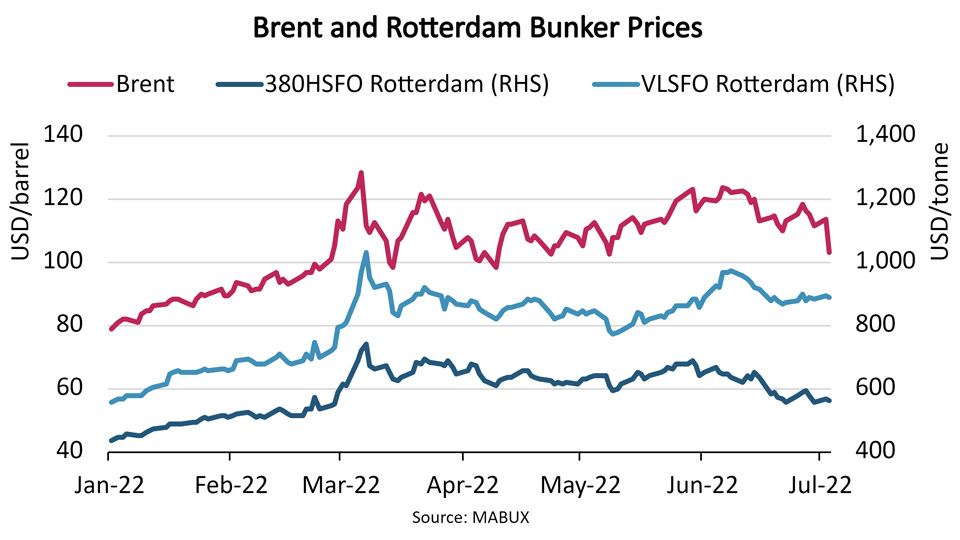

Bunker prices have naturally followed crude prices upwards and in Rotterdam the prices remain at USD 27/tonne and USD 194/tonne higher than pre-war prices for HSFO and VLSFO respectively,

In Rotterdam, the premium over pre-war prices peaked in early March at USD 207/tonne and USD 336/tonne for respectively 380HSFO (high sulphur fuel oil) and VLSFO (very low sulphur fuel oil).

The high bunker prices have increased both shipping and operating costs, especially on ships without scrubbers and which require VLSFO to operate. Crude futures are, however, now indicating that this recent price reduction will stick.

According to MABUX, Brent futures for September and October are trading in a USD 100-104/barrel range while August and September futures for WTI are trading in a USD 97-100/barrel range. Citi analysts’ base case meantime predicts that Brent will fall to USD 85/barrel by the end of 2022.

Uncertainties about the oil market remain high and price predictions vary wildly – from Citi’s low case at USD 65/barrel to JP Morgan Chase’s high case at USD 380/barrel, while the consensus appears to be for prices to remain at around USD 100/barrel.

A global economic recession would lower demand and cause prices to go as low as USD 65/barrel assuming supply stays up. On the other hand, the EU ban on Russian oil could lead to retaliations by Russia and lower supply by as much as 5 million barrels per day and push prices to as much as USD 380/barrel.

Shippers and shipping companies will normally agree that lower crude and bunker prices are to be preferred, however, right now most will probably be happy for crude to stay around USD 100/barrel as much lower prices will be a reflection of adverse global economic developments that help no one.

Feedback or a question about this information?

BIMCO's Shipping number of the week

- Container ship fleet expands by 11%, fastest growth in 15 years

- Dry bulk newbuild contracting fell 34.2%, despite a strong market

- Newbuilding prices climb 3% to highest level in 16 years

- Charter owners’ share of fleet has fallen to 40%, lowest since 2002

- Dry bulk sailing distances jump 31% for routes using the Panama Canal

ELSEWHERE ON BIMCO

Contracts & Clauses

All of BIMCO's most widely used contracts and clauses as well as advice on managing charters and business partners.

Learn about your cargo

For general guidance and information on cargo-related queries.

BIMCO Publications

Want to buy or download a BIMCO publication? Use the link to get access to the ballast water management guide, the ship master’s security manual and many other publications.