Container fleet growth up 11.6% from June 2019, catching up with transport demand

In June 2022, container volume in head-haul and regional trades were 12.4% higher than in June 2019 according to Container Trades Statistics. Transport demand was 10.1% higher as a change in the trade mix has slightly reduced the average sailing distance. The fleet has grown 11.6%.

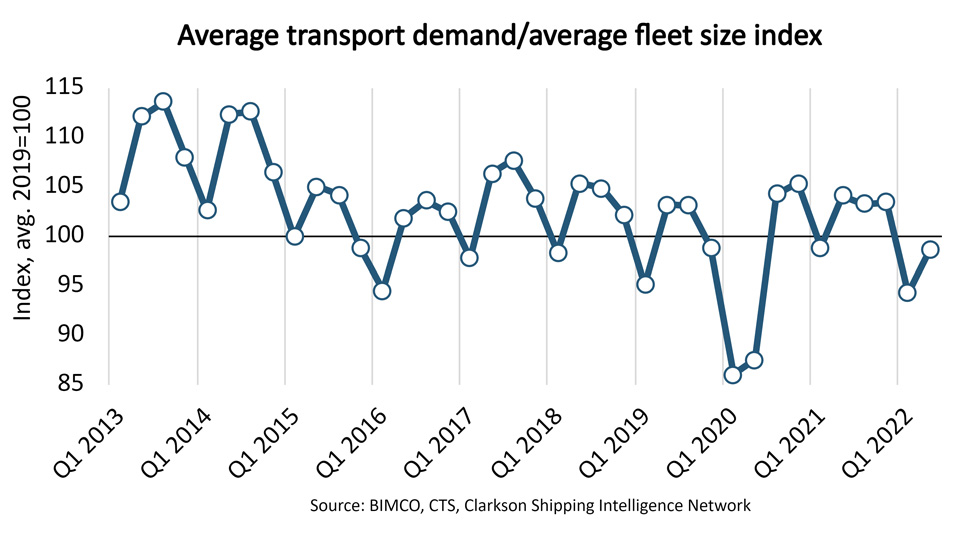

To illustrate the development in the relationship between fleet size and transport demand, BIMCO has created a transport demand/fleet size index with average 2019 as base line. As the index does not include congestion’s drain on supply, it allows a comparison between the current market situation and the past, assuming there was no congestion. This helps identify whether the current market strength is driven by transport demand, congestion, or both.

From the transport demand/fleet size index it becomes clear that by now congestion is the reason why the current market is stronger than in 2019. So far this year, the index has only been higher than 2019 in February.

According to normal seasonality, transport demand should be about 2.5% higher than June in July and August and 4-5% lower until the pre-Lunar New Year rush begins towards the end of the year. This year, however, the peak season may be non-existent and the low season more sluggish than normal due to the current global economic conditions. On the other hand, the fleet will likely grow another 2% before the end of the year.

If, or when, congestion eases, the first effects should be further reductions in time charter rates and fixture periods. Despite lower time charter rates, spot freight rates could hold up as liner operators can reduce available transport capacity by redelivering time charter vessels and/or idling ships. In the past, liner operators have, however, not been very successful at that for very long.

Feedback or a question about this information?

BIMCO's Shipping number of the week

- Iron ore shipments up 3.8% despite weak Chinese demand

- COVID pandemic wiped 24.6 million TEU off container market growth

- EU tanker import tonne mile demand up 12% as ships avoid Red Sea area

- Demand shocks drive ship recycling to lowest level in 20 years

- 13% of world seaborne trade under attack from Houthis and Somali pirates

ELSEWHERE ON BIMCO

Contracts & Clauses

All of BIMCO's most widely used contracts and clauses as well as advice on managing charters and business partners.

Learn about your cargo

For general guidance and information on cargo-related queries.

BIMCO Publications

Want to buy or download a BIMCO publication? Use the link to get access to the ballast water management guide, the ship master’s security manual and many other publications.